The stock market’s apparent strength on the surface can be misleading. To gain a more accurate understanding, one must delve deeper and examine the performance of specific sectors and individual companies.

The S&P 500 (upper) and Nasdaq (lower) have shown strong performance over the past year, as evidenced by the picture below.

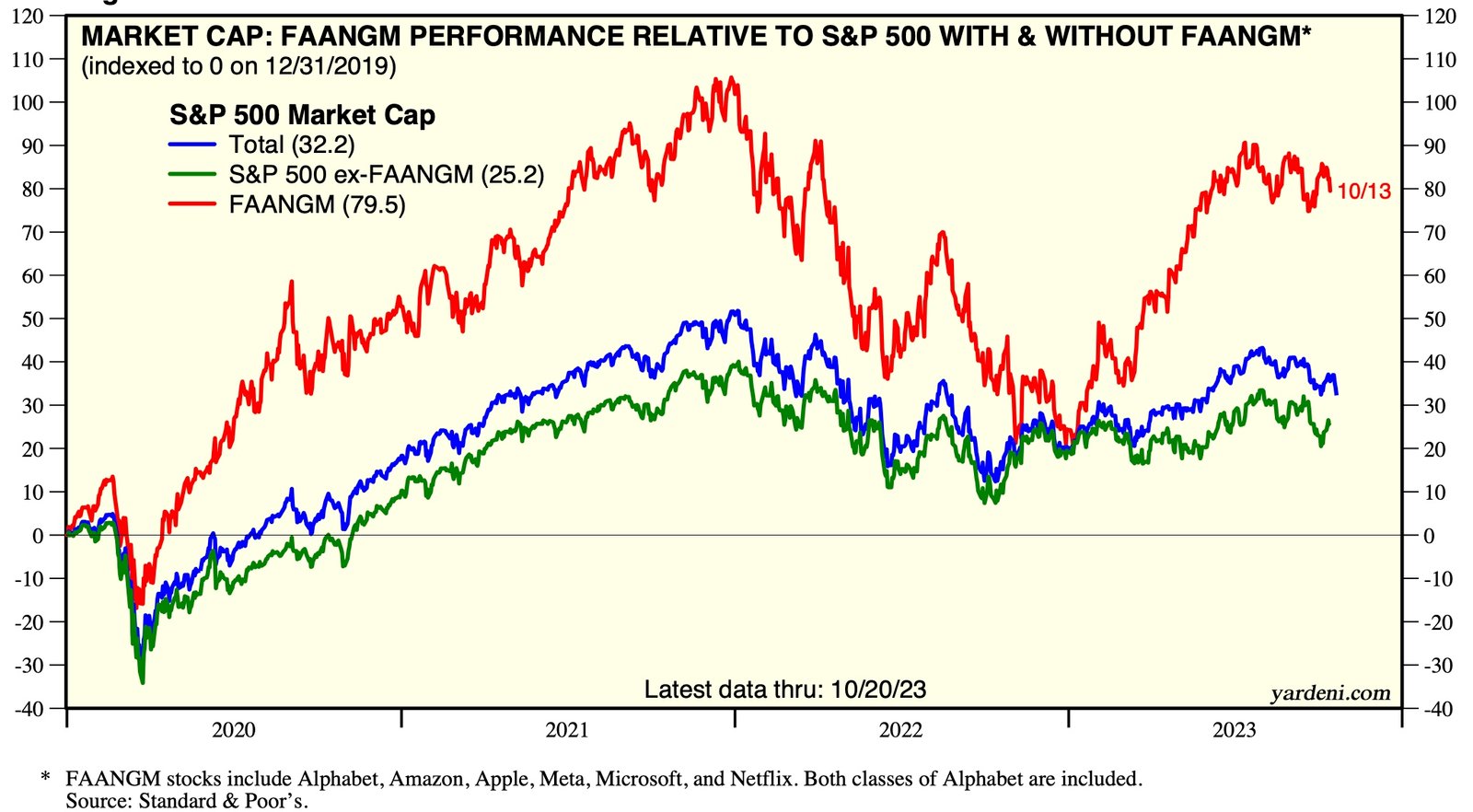

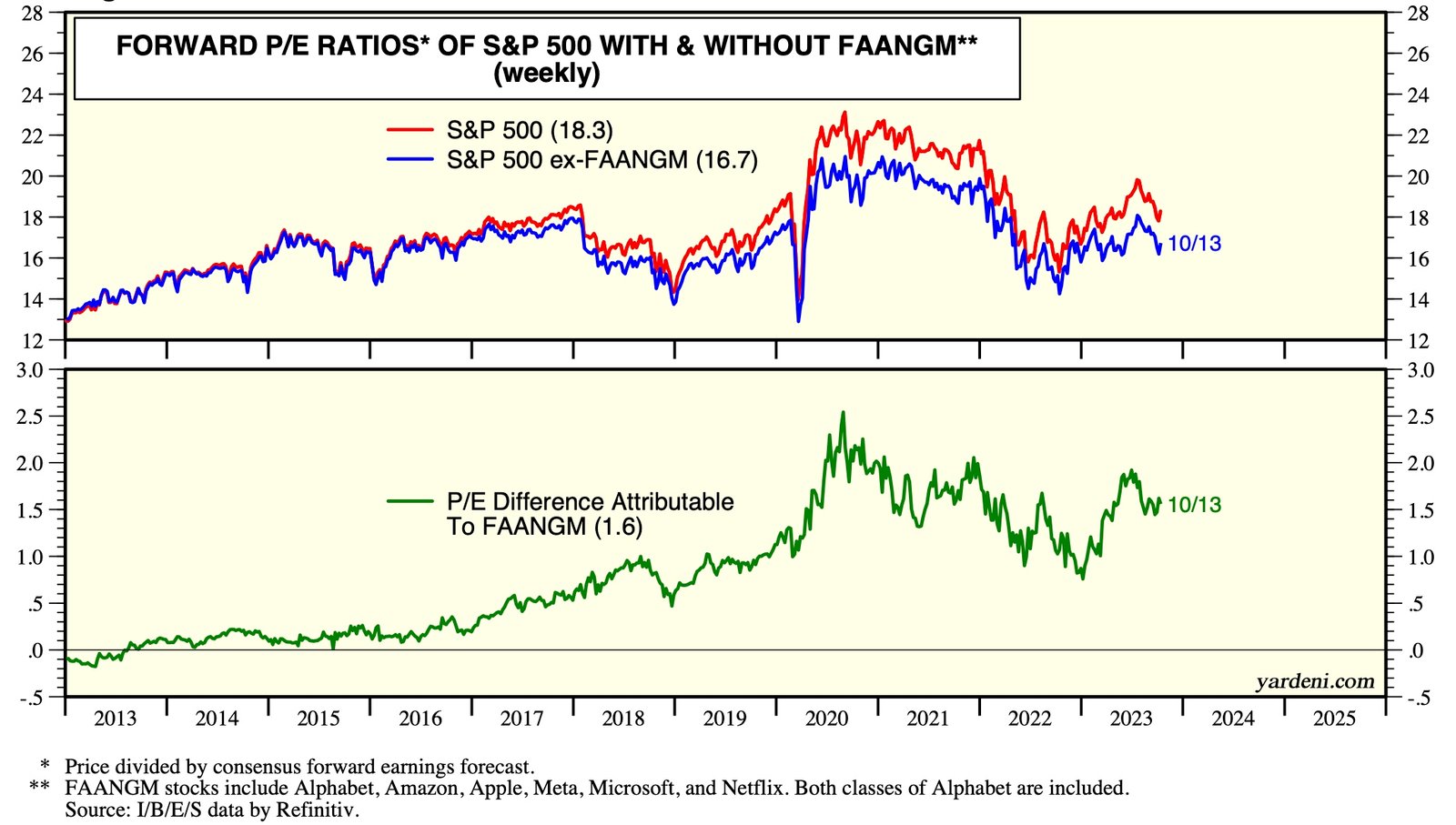

To gain a comprehensive perspective, it’s essential to analyze the performance of various sectors and industries. A notable trend is the disparity in performance, primarily influenced by the remarkable performance of the “Magnificent Seven” (FAANGS). The chart illustrates this disconnect, highlighting that the S&P 500 (excluding FAANGS) has essentially remained flat over the past year(s).

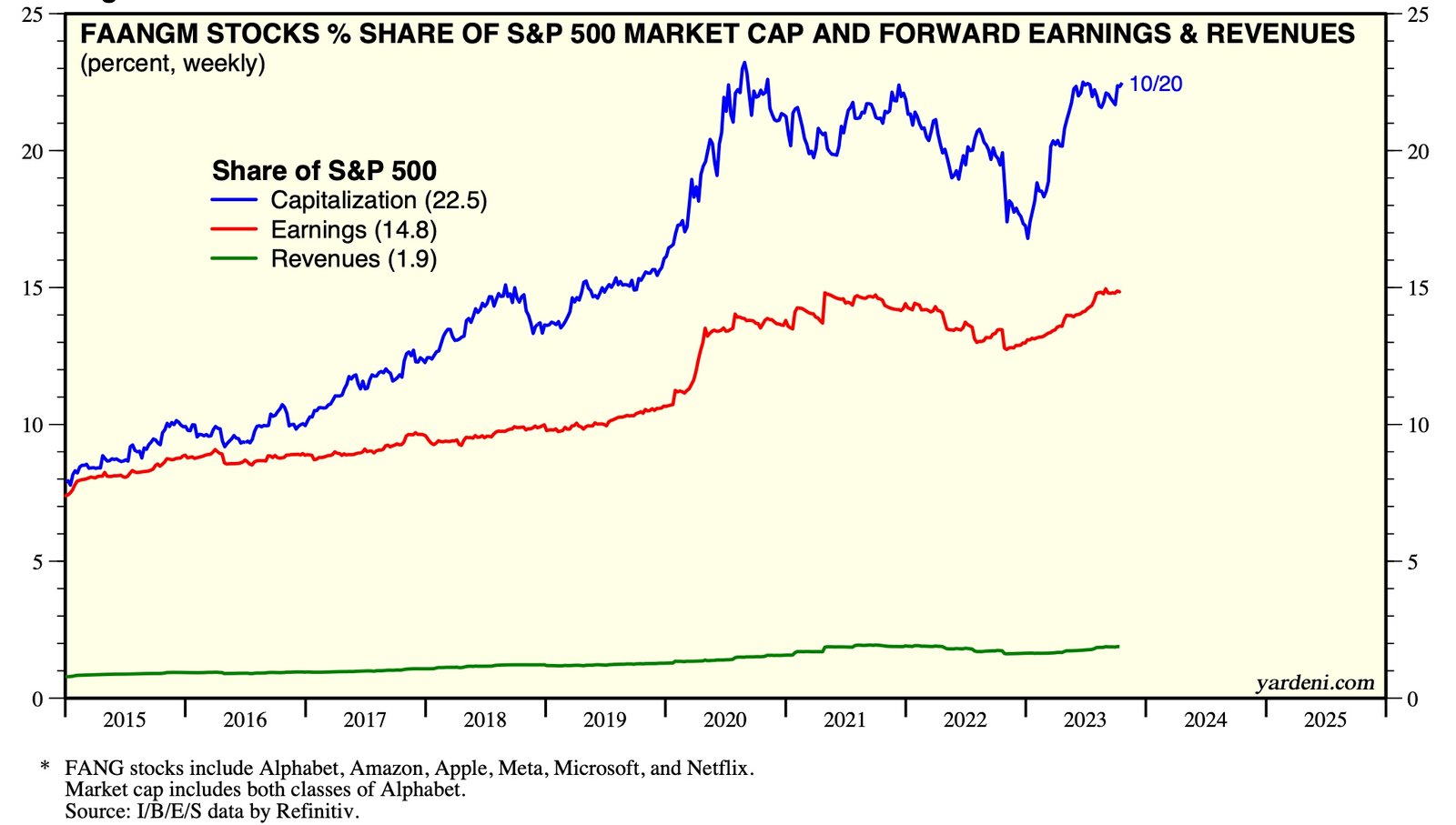

This distortion is further evident when examining the market share of the FAANGs within the S&P 500. These tech giants are commanding an even greater portion of the overall index weight, which serves to further skew the true underlying performance of the market (see below)

The remarkable adoration for the Magnificent Seven can be attributed to several compelling factors: their impressive top-line growth (both anticipated and achieved), a relentless commitment to innovation driven by their extensive reach and incorporation of cutting-edge technologies like AI, a consistent pattern of consolidation, and more recently, their role as a safe haven during uncertain times. As a result, margins, profitability, and, ultimately, their valuations have all marched in step with these trends.

A closer examination of the FAANGs reveals their immense influence, not only in terms of market capitalization but also their impact on the top and bottom lines as a percentage of the total S&P 500 constituents. This data provides crucial insights into the concentration and sway these companies hold within the broader market.

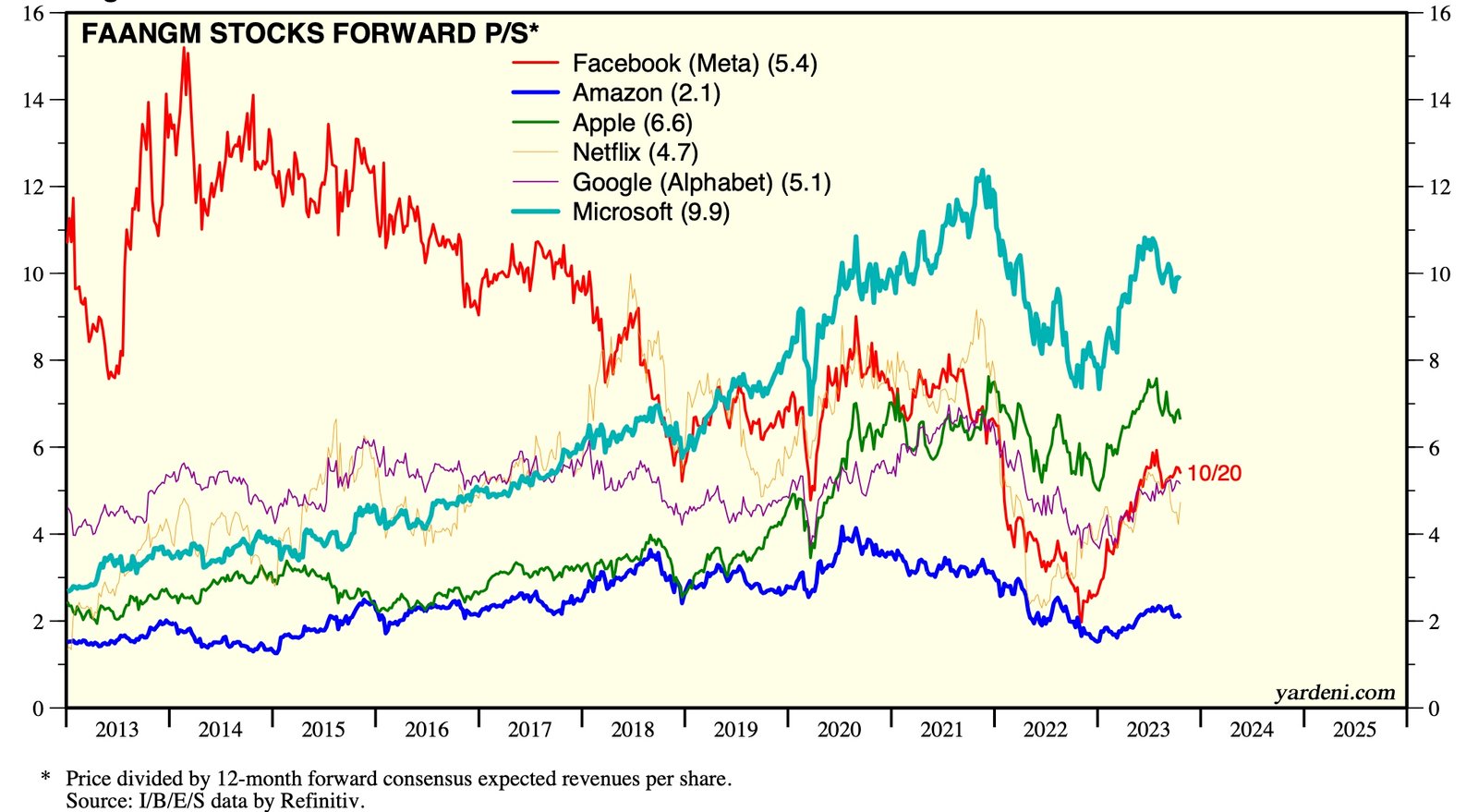

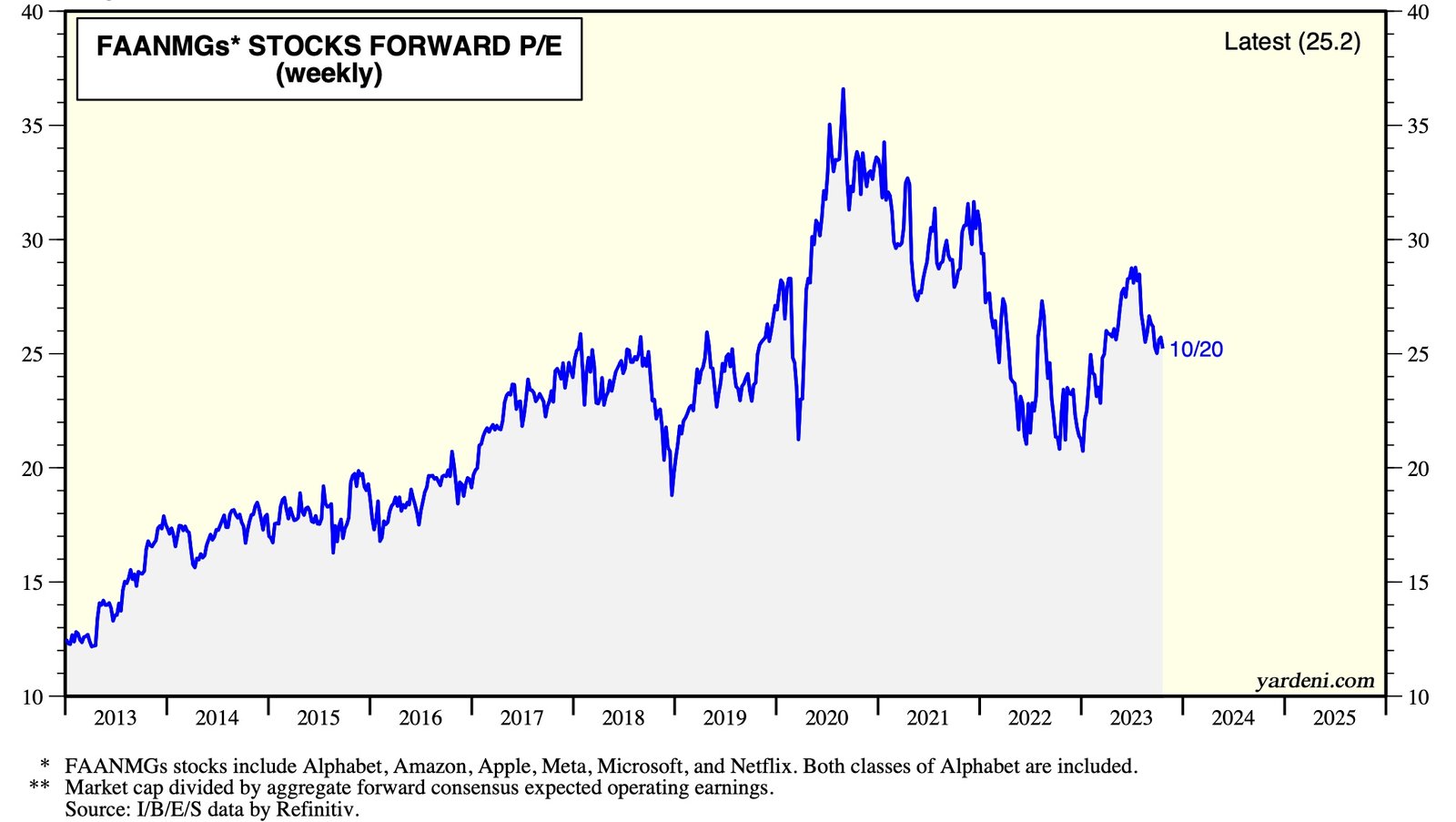

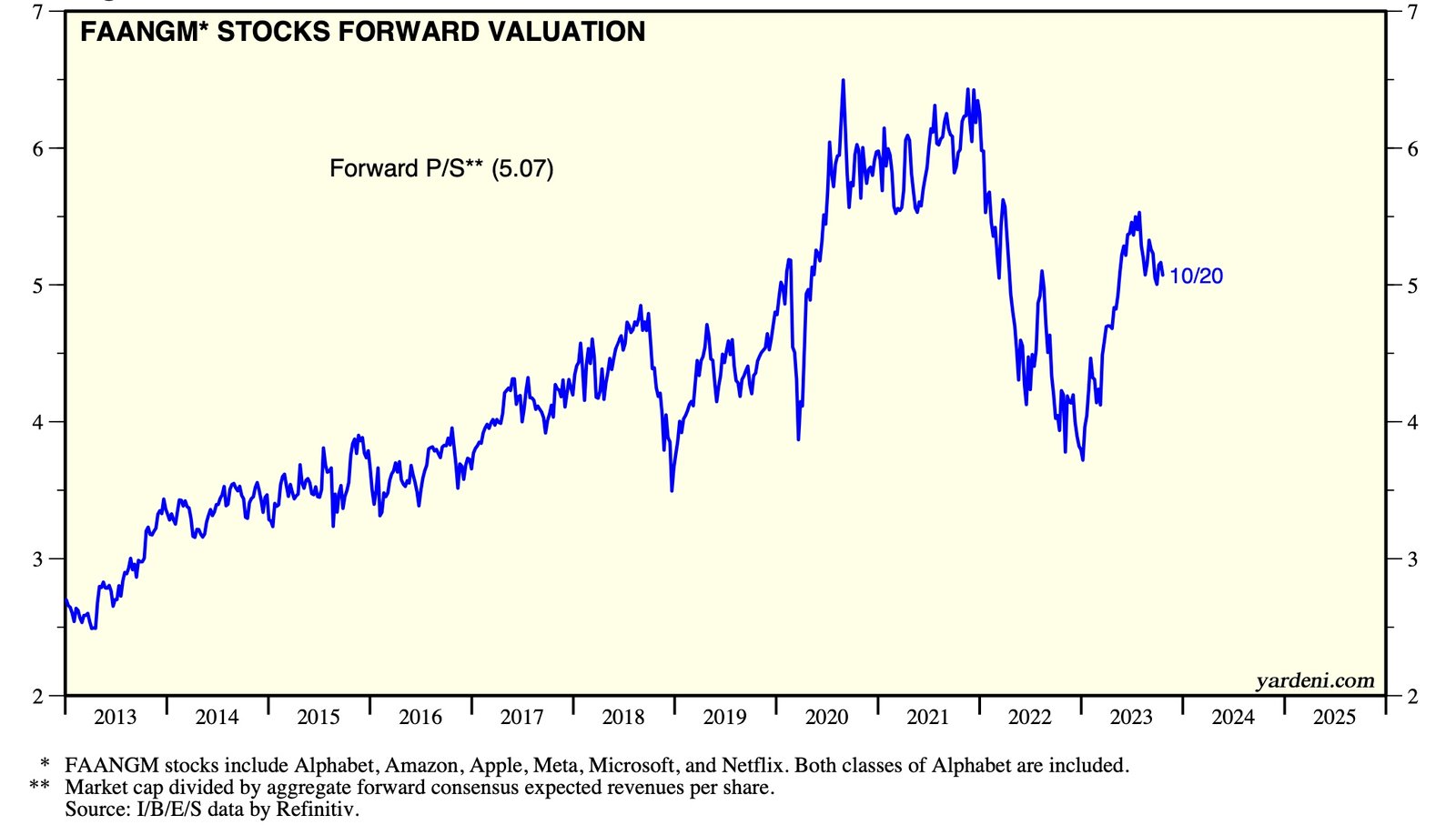

The premium valuations attached to the FAANGs reflect the Market’s recognition of their exceptional performance. When assessing various valuation metrics such as price-to-earnings (P/E) and price-to-sales (P/S) ratios, it’s evident that the Market has been rewarding their outstanding achievements, underscoring the investor sentiment that justifies these premium valuations.